As Bullish Sentiment Clashes With Fundamentals, What’s the Gold Price Forecast?

As investor sentiment shows signs of slippage, hawkish fundamental realities should help propel the precious metals to new medium-term lows.

With the GDXJ ETF suffering another daily drawdown and the S&P 500 also ending the Nov. 16 session lower, bullish sentiment is clashing with deteriorating fundamentals. Moreover, with misguided pivot optimism languishing, investors are slowly realizing that the U.S. federal funds rate (FFR) is likely far from its medium-term peak. To explain, I wrote on Aug. 1:

While the consensus assumes the Fed is near the end of its rate hike cycle, the Consumer Price Index (CPI) is on the fast track to 2% and a 3% FFR will be enough to capsize inflation, market participants are living in fantasy land.

For example, I’ve warned on numerous occasions that demand is much stronger than the consensus realizes. With Americans’ checking account balances at unprecedented all-time highs and the Atlanta Fed’s wage growth tracker hitting an all-time high in June, the FFR needs to go meaningfully above 3%. To explain, I wrote on Jul. 25:

With more earnings calls showcasing how the situation continues to worsen, market participants don’t realize that the U.S. federal funds rate needs to hit ~4.5% or more for the Fed to materially reduce inflation. For context, the consensus expects a figure in the 2.5% to 3.5% range.

To that point, San Francisco Fed President Mary Daly said on Nov. 16:

“Pausing is off the table right now, it’s not even part of the discussion. Right now, the discussion is, rightly, in slowing the pace (…). The holding part is really important. It is a raise-to-hold [FFR] strategy.”

Thus, while I warned that the FFR would rise much more than investors expected, Daly agrees. In addition, with the crowd still underestimating inflation, don’t be surprised if our 2023 FFR estimate of 4.5% to 5.5% proves too low when it’s all said and done.

Please see below:

Source: Bloomberg

Source: Bloomberg

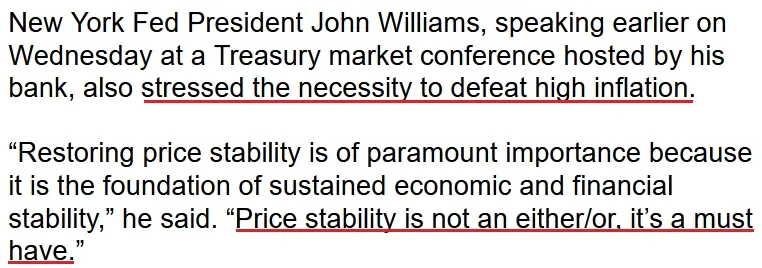

Likewise, even New York Fed President John Williams (a major dove) said on Nov. 16 that reducing inflation “is of paramount importance.”

Please see below:

Source: Bloomberg

Source: Bloomberg

So, while the crowd continues to anticipate a phantom pivot, the reality is that growth, inflation, and employment are nowhere near levels that would support a dovish 180; and while investors often take small victories and extrapolate a trend, the Consumer Price Index (CPI) has only underperformed expectations in two of the last 12 months.

Furthermore, the Atlanta Fed’s Sticky CPIs remain at their 2022 highs. Therefore, investors’ unrealistic expectations should lead to material re-pricings of gold, silver, mining stocks, and the S&P 500 over the medium term.

The Splurge

While I warned throughout 2021 and 2022 that resilient demand would keep inflation uplifted, we once again find ourselves in a situation where the crowd is ready to claim victory. However, while some inflation progress has occurred, history shows the CPI doesn’t magically fall from 9% to 2%.

Moreover, with the recent data supporting the argument, the current optimism is doomed to fail. To explain, I wrote on Mar. 31:

There is a misnomer in the financial markets that inflation is a supply-side phenomenon. In a nutshell: COVID-19 restrictions, labor shortages, and manufacturing disruptions are the reasons for inflation’s reign. As such, when these issues are no longer present, inflation will normalize and the U.S. economy will enjoy a “soft landing.”

However, investors’ faith in the narrative will likely lead to plenty of pain over the medium term. For example, I’ve noted for some time that the U.S. economy remains in a healthy position; and with U.S. consumers flush with cash and a red hot labor market helping to bloat their wallets, their propensity to spend keeps economic data elevated.

Likewise, while most investors assumed that consumer spending and inflation would fall off a cliff when enhanced unemployment benefits ended in September, the reality is that neither will die easy.

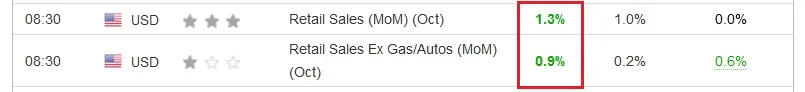

To that point, the U.S. Census Bureau released its retail sales report on Nov. 16; and with the metric hitting a new all-time high and outperforming expectations, investors still underestimate Americans’ ability and willingness to spend.

Please see below:

Source: Investing.com

Source: Investing.com

Also, the resiliency of demand highlights why wage and output inflation should remain uplifted and force the FFR higher.

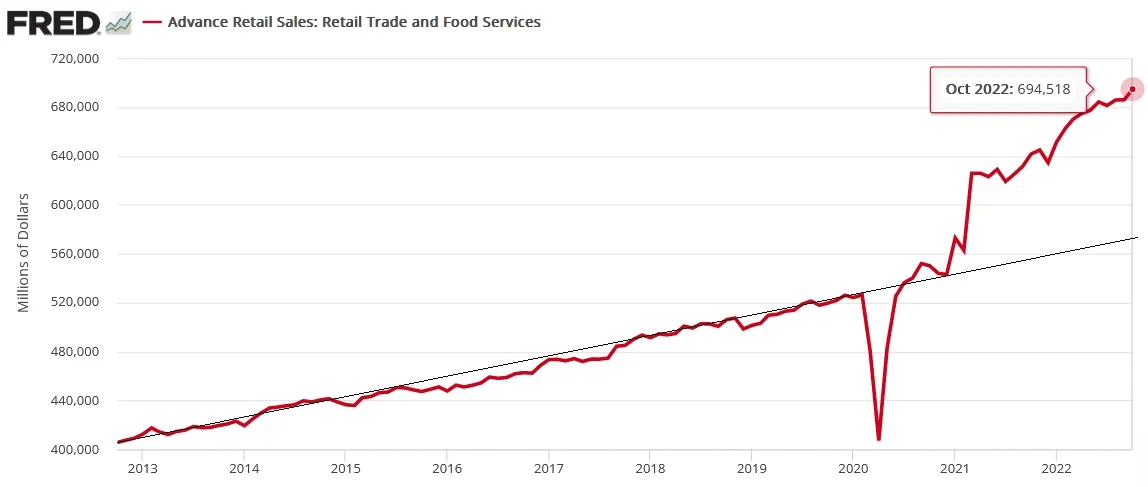

Please see below:

To explain, the red line above tracks the dollar value of U.S. retail sales. If you analyze the right side of the chart, you can see that the Fed’s 15 25 basis point rate hikes in 2022 have done little to slow down American consumers.

Furthermore, the black line above approximates retail sales’ 10-year trend. If you focus your attention on the post-pandemic decoupling, you can see that the red line continues to run away from the black line; and while ZeroHedge may proclaim that consumers are “tapped out,” the narrative couldn’t be further from the truth. As a result, the Fed has achieved very little in its bid to cool demand.

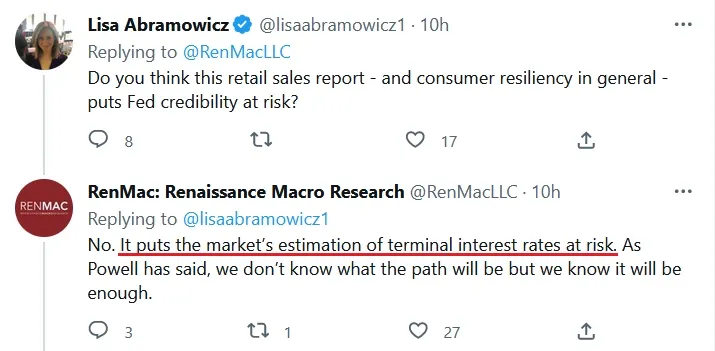

Speaking of which, even Renaissance Macro – which was late to the inflation party – sees the fundamental writing on the wall.

Please see below:

On top of that, when Bloomberg anchor Lisa Abramowicz replied to the tweet, RenMac’s response aligned with ours: the consensus underestimates the peak FFR and the amount of time it needs to remain restrictive.

Please see below:

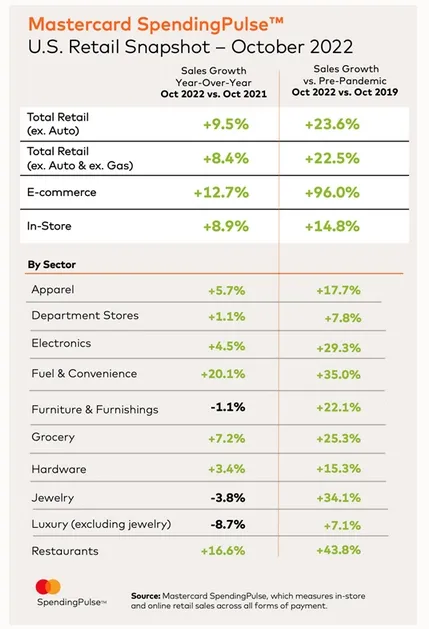

As further evidence, Mastercard released its SpendingPulse U.S. retail sales report on Nov. 15. For context, it measures Americans’ spending “across all forms of payment,” not just credit cards. An excerpt read:

“October U.S. retail sales excluding automotive increased 9.5% year-over-year (YoY) and 23.6% compared to October 2019. E-commerce sales in October grew 12.7% YoY and 96.0% Yo3Y. Experiential sectors including Restaurants, Airlines and Lodging all saw double-digit growth compared to both 2021 and 2019.”

Please see below:

Furthermore, the report stated:

“With many big-box retailers, department stores and outlet malls closed again on Thanksgiving Day, consumers will be gearing up for the main event – a Black Friday shopping blitz…. U.S. retail sales excluding automotive is expected to grow +15% on Black Friday compared to last year.”

So, while narratives move markets in the short term, please remember that the fundamentals lead the Fed; and unless real GDP growth and the U.S. labor market crash over the next few months (which is highly unlikely), the revolving door of consumer demand supporting wage inflation will continue to spin. As such, the pivot crowd lacks objectivity, and their desire for a dovish 180 results in uninformed investment decisions.

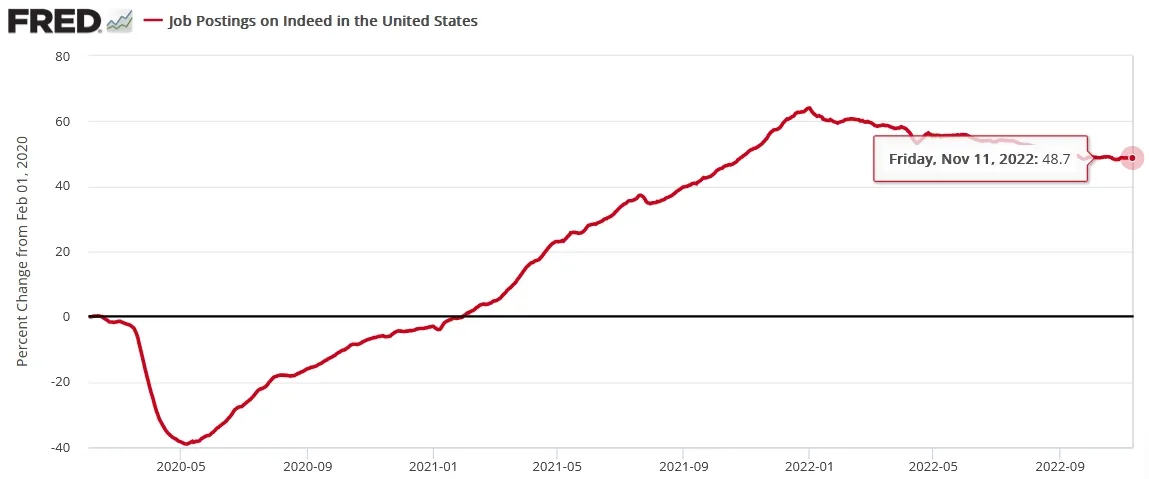

Finally, with consumer spending covered, I noted on Nov. 16 that the U.S. labor market remains on solid footing. I wrote:

Only a major recession that culminates with a collapse in the U.S. labor market should prompt the Fed to cut the FFR; and with Indeed revealing on Nov. 14 that U.S. job postings on its site are still 48.7% above its pre-pandemic baseline (for the week ending Nov. 11), we’re far from that level of demand destruction.

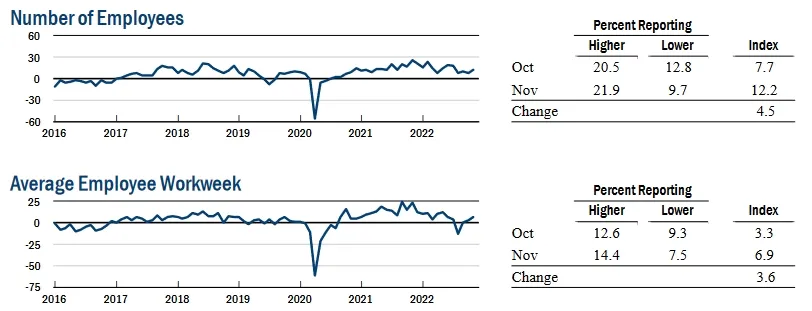

In addition, the New York Fed’s Empire State Manufacturing Survey was also constructive. I added:

“The index for number of employees climbed five points to 12.2, pointing to an increase in employment levels. The average workweek index edged up to 6.9, signaling a small increase in hours worked.”

Please see below:

Source: New York Fed

Source: New York Fed

Therefore, with real GDP growth the only unsolved variable, the latest update from the Atlanta Fed on Nov. 16 was also bullish for the FFR, real yields and the USD Index. An excerpt read:

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.4 percent on November 16, up from 4.0 percent on November 9. After this morning’s retail sales release from the U.S. Census Bureau, the nowcast of fourth-quarter real personal consumption expenditures growth increased from 4.2 percent to 4.8 percent.”

Please see below:

To explain, the green line above tracks the Atlanta Fed’s Q4 real GDP growth estimate, while the blue line above tracks the Blue Chip consensus estimate (investment banks). If you analyze the right side of the chart, you can see that the green line is moving in a hawkish, not dovish, direction.

As such, while the projection can change in the weeks ahead, the important point is that a confluence of recent data supports more hawkish policy, not less; and while the market narrative proclaims the opposite, 2022 has been filled with periods where misguided investors bought hope and sold reality. Thus, we’re likely witnessing another example right now.

The Bottom Line

While much has changed from a sentiment perspective, the fundamentals have barely budged: inflation is well above the Fed’s 2% target, consumers continue to spend, the U.S. labor market remains resilient, and the Atlanta Fed's real GDP growth expectation has increased. As a result, this is the opposite of what a pivot environment looks like, and the crowd should learn this lesson the hard way over the medium term.

In conclusion, the PMs were mixed on Nov. 16, as silver ended the day in the green. However, investors are misreading the fundamentals, and their expectations for rate cuts contrast with the realities confronting the U.S. economy. So, seasonality is the only thing the stock market bulls have going for them right now.

Alex Demolitor

Precious Metals Strategist