Does Gold Shine if the Dollar Dives?

The crowd assumes that ‘peak Fed’ means the dollar’s demise. Is it really that simple?

While we warned on numerous occasions that base effects would suppress the headline Consumer Price Index (CPI) until after the June print, the gambit ended with the metric hitting 3.10% year-over-year (YoY) on Jul. 12. And with gold celebrating the news, it may seem like a material shift has occurred in the precious metals market.

Conversely, the fundamentals have not deviated from our expectations, and optimism is much more semblance than substance. To explain, we wrote on May 19:

We’ve noted repeatedly that base effects have been the primary driver of the headline CPI’s YoY deceleration. But, when those benefits end in June, resilient month-over-month (MoM) prints should push the metric higher.

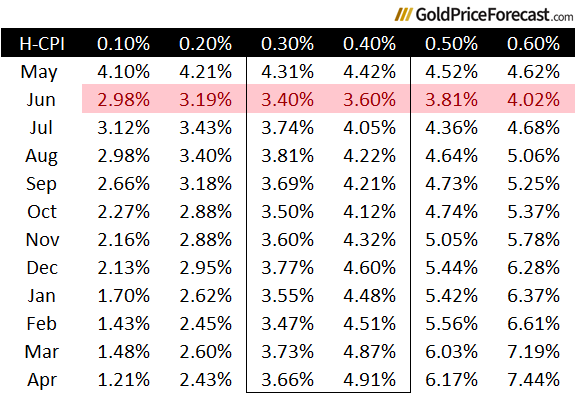

Please see below:

To explain, the black area at the top of the table measures hypothetical MoM changes in the headline CPI, while the figures below represent the YoY readings. If you analyze the shaded pink/red area, you can see that the YoY headline CPI should bottom in June.

Moreover, the box/rectangle near the middle shows that if the headline CPI continues to print 0.30% to 0.40% MoM going forward, the metric will remain stuck near the 3.50% to 5% range over the next 12 months.

So, while June’s CPI print came in near the low end of the YoY range, a 3-handle was not a surprise, and the trajectory remains aligned with our expectations. Furthermore, with base effects now a thing of the past, hot MoM prints will look much worse in the months ahead, which is bearish for silver and mining stocks.

As evidence, even Bank of America understands the dynamics that should unfold as the inflation war continues.

Please see below:

To explain, we’ve repeatedly mentioned that the headline CPI needs to print ~0.17% MoM to align with the Fed’s 2% target. Yet, with base effects now gone, inflation should trend higher, with 3% to 4% the likely range over the next several months. As such, while the crowd may opine that we’ve seen ‘peak Fed,’ the reality is that inflation’s dovish days are in the rearview.

Remember, oil prices have risen materially over the last couple of weeks, and the S&P GSCI (commodity index) is up by 4.6% so far in July. Therefore, the pricing in of a dovish pivot and a weaker U.S. dollar have already increased MoM inflation, and these dynamics should be more obvious over the medium term.

Central Bank Warnings

The Bank of Canada (BoC) increased its overnight lending rate by another 25 basis points on Jul. 12, and the official press release read:

“With three-month rates of core inflation running around 3½-4% since last September, underlying price pressures appear to be more persistent than anticipated. This is reinforced by the Bank’s business surveys, which find businesses are still increasing their prices more frequently than normal…. [The] Governing Council remains concerned that progress towards the 2% target could stall, jeopardizing the return to price stability.”

As a result, while the narrative implies the inflation war is over, a soft landing is inevitable, and new bull markets are underway, the fundamentals don’t support the optimism.

To that point, Cleveland Fed President Loretta Mester said on Jul. 10:

“The economy has shown more underlying strength than anticipated earlier this year, and inflation has remained stubbornly high, with progress on core inflation stalling. In order to ensure that inflation is on a sustainable and timely path back to 2%, my view is that the funds rate will need to move up somewhat further from its current level and then hold there for a while as we accumulate more information on how the economy is evolving.”

San Francisco Fed President Mary Daly said on Jul. 10:

“We're likely to need a couple more rate hikes over the course of this year to really bring inflation” sustainably back to the 2% goal.

Richmond Fed President Thomas Barkin said on Jul. 12:

“Inflation is too high. If you back off too soon, inflation comes back strong, which then requires the Fed to do even more.”

So, while the USD Index has suffered as the crowd declares premature victory, more hawkish policy should materialize in the months ahead, and the prospect is bearish for the PMs.

Furthermore, while you may believe the PMs’ recent rallies are a function of the fundamentals, the reality is that they’re primarily momentum driven.

Please see below:

To explain, the blue line above tracks Commodity Trading Advisors' (CTAs) exposure to gold (as of Jul. 6). And with the algorithms prone to shoot first and ask questions later, their positioning is driven by sentiment, not economic conditions.

If you analyze the right side of the chart, you can see that the momentum crowd is near the high-end of its ~10-year range regarding its affinity for the yellow metal. But, while momentum trading looks great on the upside, it can be even more painful on the downside. As a result, if (when) the CTAs turn their backs on gold, the drawdown should be substantial.

Overall, the S&P 500 sees nothing but clear skies, even though fundamental risks remain extremely elevated. And with other assets riding the wave, the bullish frenzy has decoupled prices from the ominous realities that should emerge over the medium term. As such, we believe the PMs’ bear markets still have room to run.

Do you believe a soft landing is on the horizon?

Alex Demolitor

Precious Metals Strategist