Gold Price Forecast for September 2024

Forecasting gold prices tends to be a difficult task... But not this time.

EDIT: Visit this link for Gold Price Forecast for October, 2024

Geopolitics, monetary statements, wars, threats, all sorts of events… And yet, when it comes to making a prediction for gold in September, it seems rather easy.

Surprised?

The thing is that gold price tends to behave very specifically after the U.S. Labor Day, which takes place in early September (yesterday). And since this tendency is even stronger during the U.S. Presidential election years, the outlook for gold during this month seems quite clear.

Let’s dig in.

Gold Price in September and the U.S. Labor Day

(if the below chart is not clear, please click it to enlarge it)

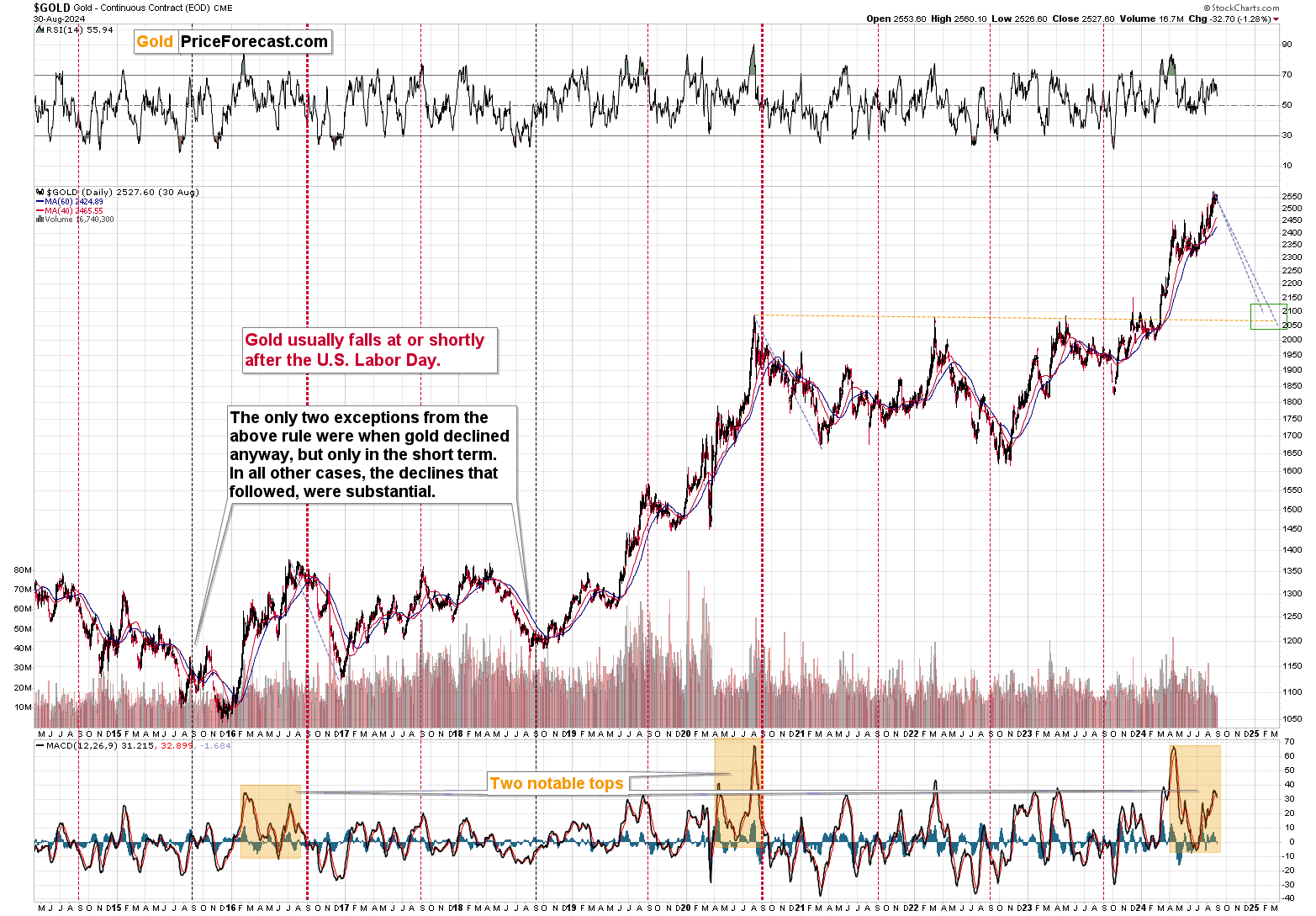

In almost all (8 out of 10) cases gold declined at or shortly after the U.S. Labor Day. This is a truly remarkable statistic given that gold moved much higher during the past decade. The latter means that if one put dates randomly on the chart, they would likely get most cases after which gold rallied.

Not in case of the U.S. Labor Day. And did gold soar after those two remaining cases? Not really. In 2018, gold first consolidated (it then declined, but not immediately so, and in 2015 it’s a tough call to say what really happened next – was it a rally or a decline, because it changes with a little change in perspective.

Also, the 2018 case was after a several-month-long decline in gold – this is NOT where we are right now. In 2015, gold was in a medium-term downtrend as well. Again – not similar to what we have now. The current case is more similar to what we saw in 2016, 2017, or 2020 – that’s where the major top was formed and when big declines in gold followed the U.S. Labor day.

Consequently, in my view, even if gold doesn’t slide this week (it’s already moving lower…), it’s VERY likely to slide in the first half of September.

The above is a very powerful long-term indication. The short-term confirmation that we saw in the form of the breakdown below the rising wedge pattern is just a cherry on the analytical cake.

There are two more things that I’d like to add on top of the above.

One of them is that I used bolder vertical lines for two years: 2016 and 2020. These were the years when there were U.S. presidential elections, so gold had a good reason to rally – in theory, due to uncertainty. Did it rally after the U.S. Labor Day in those years?

Absolutely not.

Conversely, those were the two cases where the biggest declines followed!

Interestingly, in both cases, gold topped before the Labor Day, and it accelerated its decline after it. The same appears to be the case this year.

The second tweak on the above chart is marking two specific cases in the MACD indicator (bottom part of the chart) – there were two tops in this indicator in 2016 and in 2020, and we see the same kind of pattern this year, which further increases the link between them.

Gold Price Prediction – Possible Downside Target

If this similarity continues, we can expect gold to decline toward $2,000 – I marked the previous declines with blue dashed lines, and I copied them to the current situation.

If gold provides us with good bullish confirmations at $2k or close to it, we might be going long in a big way. It’s a big if, of course. What appears more likely in my view (at the moment of writing these words – which might change in the future) is a breakdown below this level, but I wanted to emphasize that I’m going to keep my eyes open and on the lookout for bullish signs.

Anyway, if the decline to this level is going to be accompanied by a decline in stocks (which is likely), junior mining stocks can slide really profoundly, even if gold declines by “just $500” or so.

All in all, the gold price forecast for September 2024 is bearish as a very powerful tendency just started to come into play and based on the first session of this month, it’s likely to play out exactly as expected.

Thank you for reading my today’s free analysis. If you’d like to read more and stay up-to-date with the quick trades, intraday Gold Trading Alerts, and all the key details (trading position details, profit-take levels) that my subscribers are getting, I invite you to sign up for my Gold Trading Alerts or the Diamond Package that includes them. Alternatively, if you’re not ready to subscribe yet, I encourage you to sign up for my free gold newsletter today.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief