No Changes in Gold Price, but Miners Already Show the Way

Gold did nothing yesterday, but the USD Index showed strength, and miners moved down - a sign of more bearish things to come.

Gold literally moved by 0% yesterday – it closed just where it had closed on Tuesday.

Consequently, everything that I wrote about it yesterday, including the analogy to how gold performed in 2012 and 2013, remains up-to-date:

Taking [Tuesday’s] intraday high and the recent intraday low, it rallied by 4.6%, and it almost touched the 50% Fibonacci retracement based on this year’s decline.

And it might even appear somewhat bullish if it wasn’t for the analogy to how gold performed before one of its biggest slides of the previous decades.

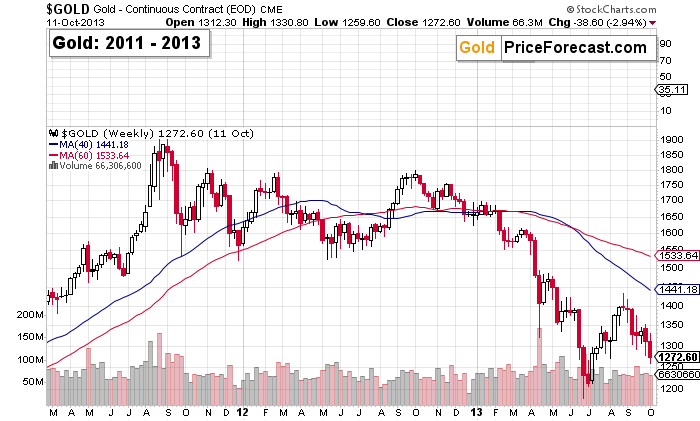

Remember the 2012-2013 decline? You know, this one:

If you don’t remember what was the prevailing sentiment in late 2012 and in early 2013, let me remind you.

It was pretty much “obvious” to everyone that gold is just consolidating and that its long-term rally is about to be resumed.

The decline that started in the second half of 2012 was shrugged off as yet another boring correction.

In reality, the local rallies that we saw in late 2012 and early 2013 were not just corrections. They were the final corrections and final chances to get out of the precious metals market and even the final signals to enter short positions in it.

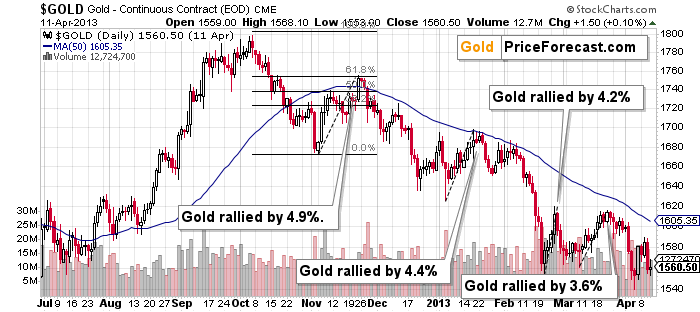

Now, the above chart includes the decline, which makes the late-2012 and early-2013 corrections barely visible. Let’s zoom in to see how big they really were.

Surprise, surprise! The biggest one was 4.9% and the second biggest one was 4.4%. In the first case – the first and biggest correction, gold moved slightly above its 50-day moving average.

Does it remind you of something? It should, because that’s exactly what we just saw. Gold moved higher by 4.6% from its recent bottom and it moved slightly above its 50-day moving average.

So, how bullish the recent move up really was? Barely.

I also wrote about the move higher in the USD Index, pointing to the fact that we saw a very short-term breakout and its verification.

Since then, the USD Index moved higher and back to the very initial post-breakout high, thus also verifying the move above it.

This means that the outlook remains bullish. Of course, it’s not bullish just based on the above very short-term chart but also on the regular short-term and long-term charts.

Paraphrasing my yesterday’s analysis:

Zooming out, however, allows us to see that this move [higher] is pretty much nothing compared to the recent decline. The RSI was just below 30, indicating an extremely oversold condition.

This is as bullish as it gets, especially given USD Index’s tendency to turn around and form bottoms (major ones!) in the middle of the year.

This means that the slide in the value of the U.S. currency is likely overdone, and that we’re about to see much higher values soon – perhaps very soon.

And since gold was refusing to rally profoundly given USD’s weakness (it’s not at yearly highs, is it?), the impact of dollar’s rally is likely to be truly profound – and bearish.

Junior mining stocks (the GDXJ ETF) moved lower by almost 1% yesterday despite no move lower in gold, which suggests that miners “want to” move lower.

No wonder they already rallied more or less how much they had rallied during the previous corrective upswings (as seen in 2022), so a turnaround here is something to be expected.

In other words, what we saw recently is not a game-changer, it’s a regular part of the bigger moves lower.

It wasn’t likely that we’d see a corrective upswing this big from about $34, but ultimately that’s what we’re seeing, and the size of the rally is in tune with the previous corrections. Why is this important? Because it suggests that what we see is normal, not particularly bullish.

The odds for a rally in the USD Index from here are very high, which is likely to translate in much lower precious metals (and mining stocks!) and commodity (including copper and FCX) prices. And yes, this creates a tremendous trading opportunity. If I didn’t have any trading positions open right now, I would be opening them today.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief